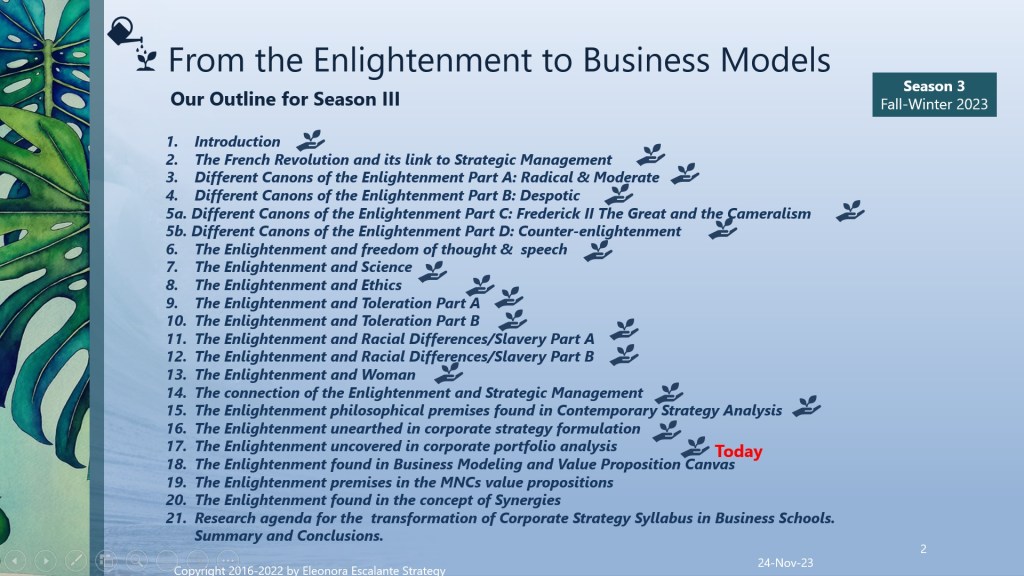

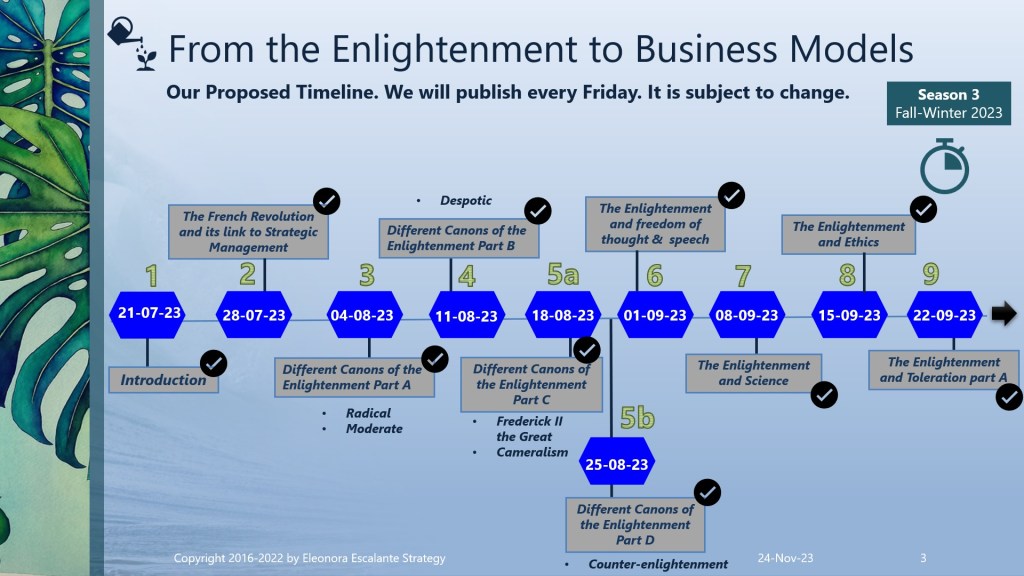

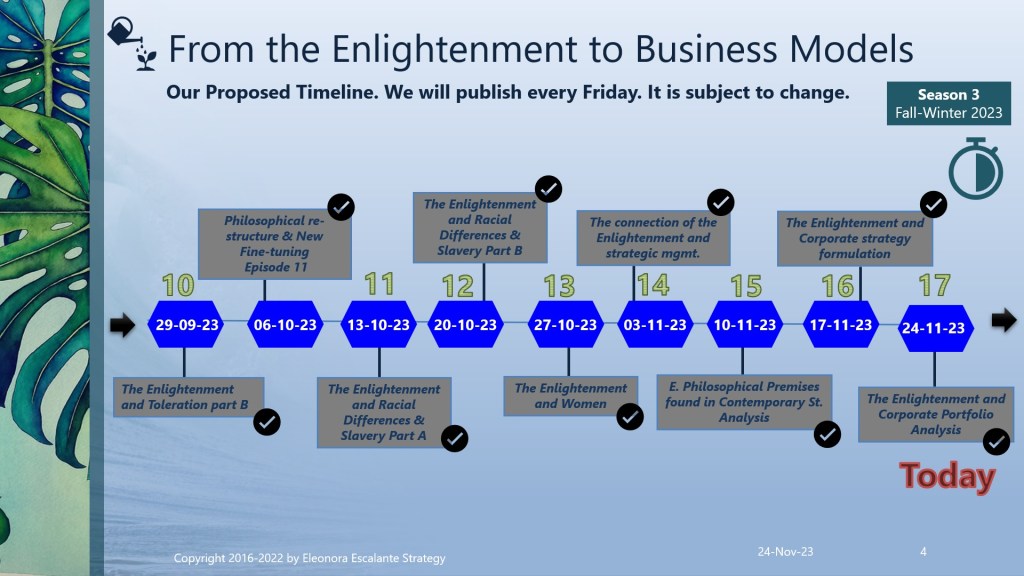

From the Enlightenment to Business Models. Season III. Episode 17. The Enlightenment Uncovered in Corporate Portfolio Analysis.

Our last weekend of November is at our door. Today´s publication about Product Portfolio Analysis will be revealing, so let´s begin. For those who have followed me for a few years, I already have performed a study about Product Portfolio Analysis. Let´s refresh some concepts first.

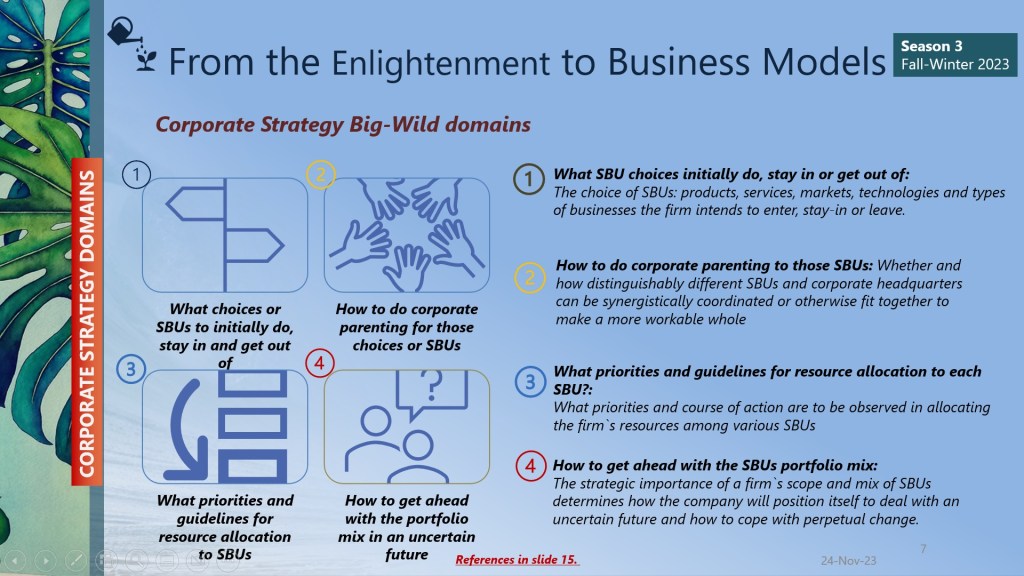

Product Portfolio Analysis is a tool for establishing priorities on directional strategies and allocation of resources towards each strategic business unit (SBU) that belongs to a whole group of businesses of our company. When we utilize the notion of portfolio analysis we are speaking about a strategic decision/making map that allows us to choose correctly in terms of guiding which strategy would be the most appropriate to follow for each and all of our SBUs.

Product Portfolio Analysis is utilized when companies have an ample range of products serving many clients in different markets (segments of population) or different geographies. Companies decide to diversify because the current world in which we sell and buy products is full of risks. Uncertainty has always accompanied humans in their commerce endeavors. To put all our eggs in the same basket is too dangerous, particularly if our product fails or belongs to the luxury economic sector, or if it doesn´t belong to the daily necessities goods, or if we live in areas where natural disasters or violence abounds. With the COVID-19 pandemic, most of us realized that to survive, companies are required to diversify their product offer. With the fluctuations of climate change, companies are required to consider products that may help them to stand operating in case of natural disasters beyond earthquakes droughts, or hurricanes. Our product portfolio must be open to considering the emergence of products that can help in rich and developing nations when facing frequent fluctuations or temperature cycles between heatwave and deep-freeze seasons. All these considerations are going to be the norm in the future.

For example: Let´s go back in time to Vevey, Switzerland, to the epoch in which the three Napoleon emperors were trying to fix Europe after the French Revolution. During the first half of the 19th century, entrepreneurs in Europe were looking to set up their first manufacturing endeavors.

Let´s explore the product mix of Nestlé Corporation. Nestlé today is a multinational corporation with more than 2000 brands pivotal to 12 segments: baby foods, water, cereals, chocolate and sweets, coffee, culinary, chilled and frozen food, dairy, drinks, food service, healthcare nutrition, ice cream, and pet care. Probably you are not aware that, his founder, Henri Nestlé (1814-1890), was a German pharmacist that decided to start his career as an apprentice in Vevey, the Swiss canton of Vaud, Switzerland in 1834. After 5 years, he started his own manufacturing firm selling oils, bone meal fertilizers, vinegar, liqueurs, white lead, mustard, mineral water, lemonade, liquid gas, cement, and others. His product portfolio was ample but his manufacturing plant still was running in artisan terms. When he was 53 years old, infant mortality was very high, and it was an old problem still not solved in Europe. Nestlé tested in his lab several formulas that could be equivalent to human breast milk. And in 1867 he was able to invent the “Farine Lactée”. This child´s flour was released into the Swiss Market a year later. In less than one year, 8,600 tins were manufactured and sold, and in 1874, production increased to 670,000. By this time, 18 countries already had their own distribution network and local Nestle agents. Regardless, that Nestlé sold its company, and then merged with its top competitor Anglo-Swiss Condensed Milk & Co.; Nestlé has been a corporation that has never stopped growing by developing new products and acquiring new brands. Nestlé is the perfect example of companies that require product portfolio analysis. Nestlé was one of the first corporations that join the wave of the First Industrial Revolution in Switzerland.

When we face multiple products and services that should be organized in different business units, that is when corporate portfolio analysis is the red carpet to choose from. As I mentioned in the first paragraph, I have already written a saga about portfolio planning and analysis a couple of years ago. It was super detailed in my explanations, and I published several episodes that can refresh your understanding. See below the link to the first of those episodes. I invite you to revisit this saga that was produced by the end of the year 2021.

Portfolio Analysis: Igniting a long term spirit in a short term world.

Product Portfolio Analysis is a representation mapping of how each of our businesses is doing in our portfolio.

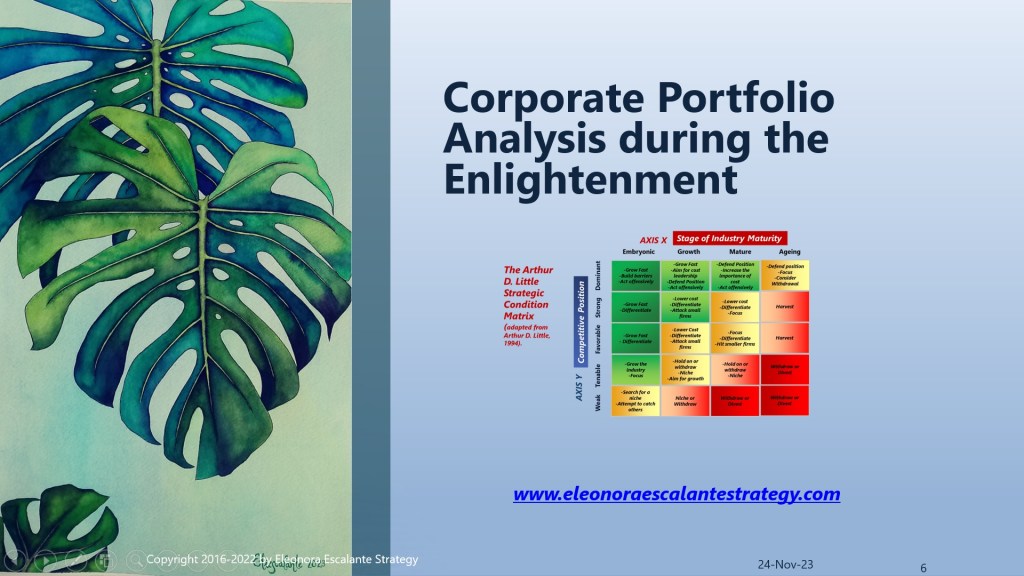

The invention of the product portfolio analysis matrixes is not new. These days, I am sure each company, with diversified business units, has improved all the original businesses’ theoretical screens used for product portfolio analysis. The BCG or growth-market share matrix, the directional policy GE-McKinsey business screen, the Shell DPM Matrix, or the Arthur D. Little Matrix, have been the most famous and recognized methodologies that helped product portfolio managers at the corporate level to develop strategy options in a systematically organized graph.

What is the connection between Product Portfolio Analysis and Enlightenment?

There are five levels of relations that we can observe:

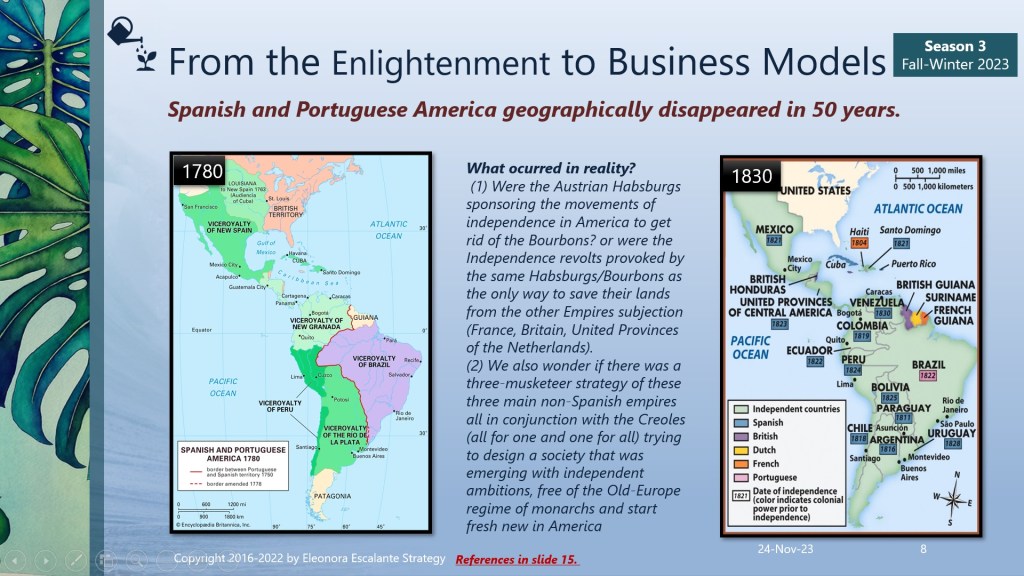

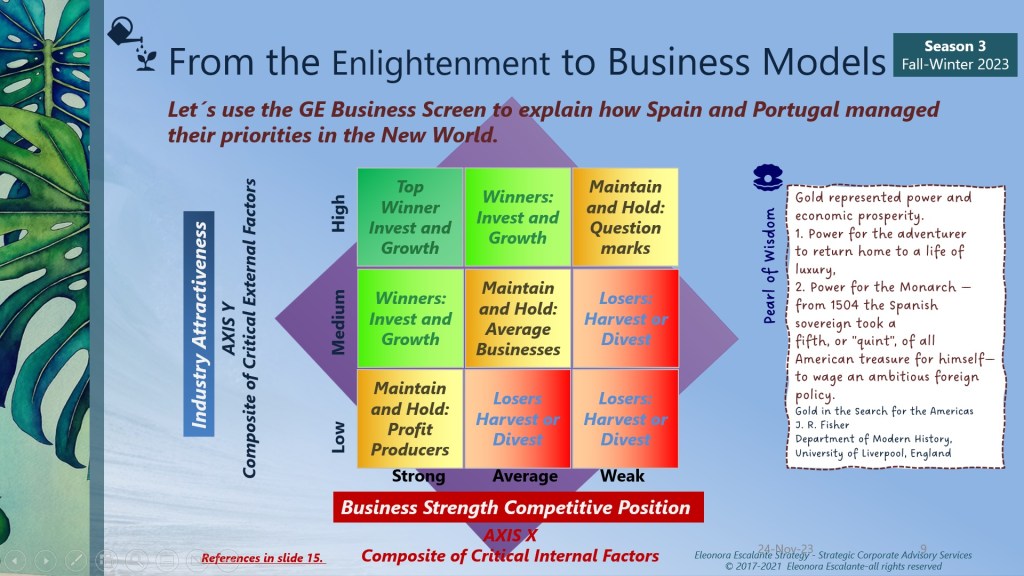

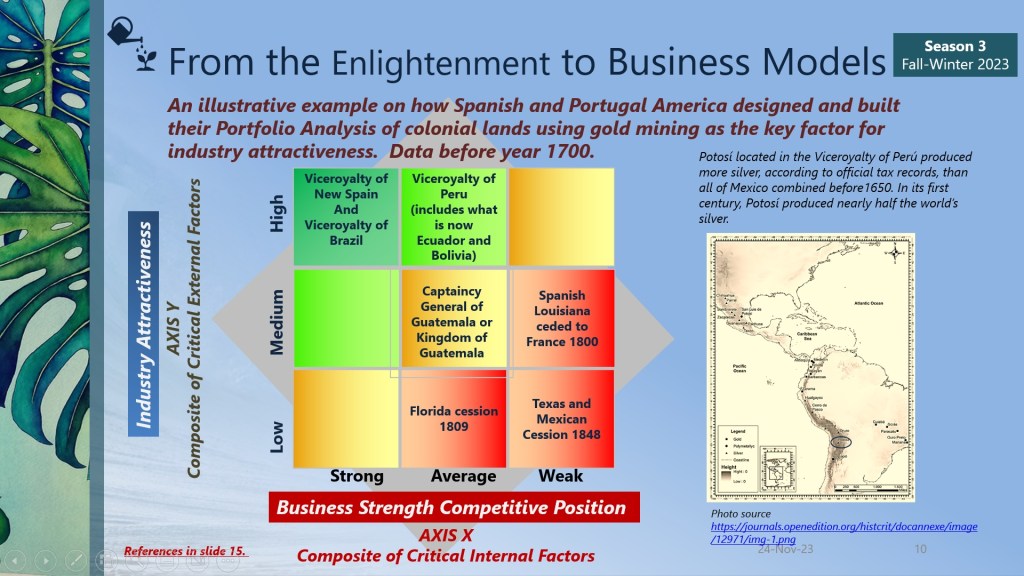

- There was a need to compare the production of resources from different regions in the New World. Particularly precious metals. In the period before the industrialization of Europe, options were conceived and studied under the framework of “scientific observation”. Descartes, Newton, Humboldt, and the rest of the Enlightenment scientists used the most modern methods of their time, with an emphasis on observation from experience to test their research. All monarchies were hiring studious specialists who were trained by Universities who could use the mathematical conventions for a good administration that was conceived with the goal of exploring different projects beyond raising taxes. Each empire was looking to this new way of wondering, not just about the next discoveries and technological advancements with curiosity, but because the Americas represented a new land of resources, and a new place out of Europe where anyone could migrate and settle with the hope of prosperity. The fear and discomfort of the newness were fading away, and every empire was using these new technologies for their advantage either for warfare or for pulling out raw materials, or for extracting precious metals and everything they could to Europe, and settlement of their colonies. Even if the directional policy matrixes weren´t yet on the horizon, each monarch and his team of administrators were doing more than a portfolio evaluation. They were using the concepts of attractiveness and business strength competitive position (without knowing). In the new world, Spain chose to settle in specific strategic locations that meant a link with gold and silver: the Viceroyalty of New Spain, and the Viceroyalty of Perú. Later during the 18th century, the Bourbons created the Viceroyalty of New Granada and the Viceroyalty of the Río La Plata. Portugal settled in the Viceroyalty of Brazil. Look at slide number 8.

- There was a need for labor in the New World to exploit those new resources. Different formats of slavery were implemented by the Spanish Crown: encomiendas, repartimientos, and pure African slavery. Product Portfolio Analysis was applied as a conceptual notion by all the empires in the 18th century, and labor was crucial for the transformation of natural resources in the format that was required in Europe. Herbert S. Klein has estimated that the number of slaves that landed from Africa in America in the period 1701-1810 was 6 million, representing 63% of the total of African Slaves transferred. It was in this period that the empires shifted from isolated trade monopolies to free trade organizations searching for labor in the cheapest forms: slaves. “The Atlantic Slave Trade became one of the most complex international trades developed by European Merchants. It involved the direct participation of East Indian Textile manufacturers, European ironmongers, African caravan traders, European shippers, and American planters in purchasing, transporting, and selling the largest transoceanic migration of workers known in recorded history”. The decision-making to utilize African slaves was to fulfill the need in terms of searching for labor that wasn´t available in the colonies. It was also a matter of productivity: the caliber of resistance of the African slaves allowed the possibilities of more wealth creation. The growth rate of the production of tobacco, sugar, cotton, silver, etc. was measured in terms of the yield that was shipped to Europe. The reason why the colonies kept using Africans for 400 years was economically beneficial: the investment in getting each slave from Africa, and its sale to a Plantation owner or intermediary probably only represented between 10 to 20% of return on investment for the slave trader, but the real economic return was in the hands of the American Planters. It was a lifetime of utilization of the slaves and their kids.

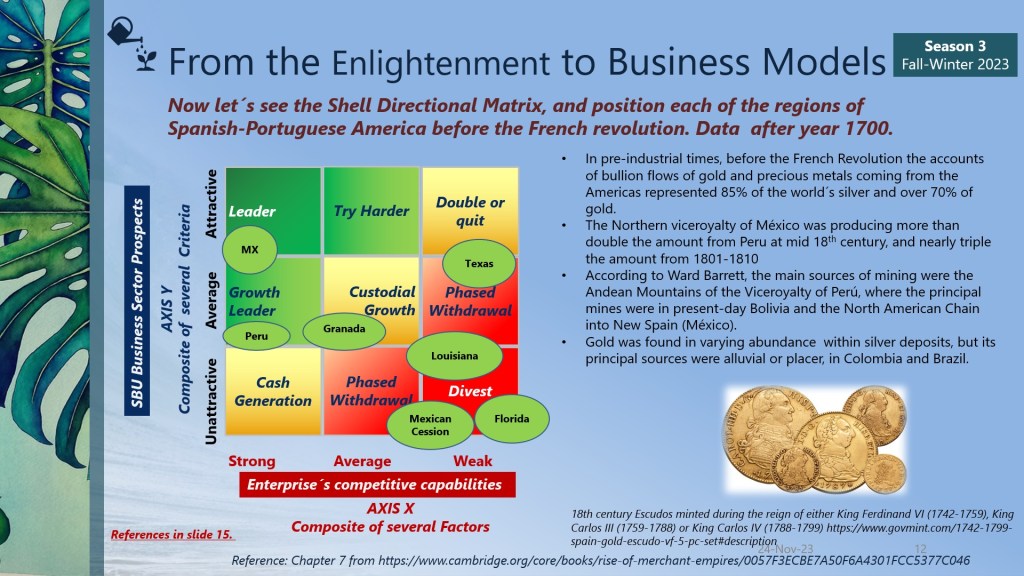

- There was a need for an adequate supply of precious metals in Europe. Spanish America during the 18th century was the main source of silver and gold for the world. After the discoveries of the mining opportunities in the new continent, economically, bullionism was the supremacy of monetary policies, international trade, and foreign exchanges. According to Glen Davies “Bullionism was the belief that trade, financial and fiscal policies should be so co-ordinated as to attract into the country the largest possible supply of bullion and conversely to minimize those factors which, if not checked, would lead to a drain of bullion away from the country”. Because of bullionism (which is like the predecessor of mercantilism), the priority for all European monarchies was to find an adequate supply of such metals for enough coinage, for economic growth, and for making each country powerful against the rest of the European enemies. Spain was by far the “solid queen” of bullionism, owning more than 85% of the production of silver in the second half of the 18th century. Additionally, around one hundred years before, the majority of writers on money also observed that a persistent influx of precious metals, if not controlled by the monarchs (smuggling was also a big issue), would bring serious inflationary consequences to Europe. Visit slides number 9 to 14, please. You will observe how portfolio analysis was used by the Spaniards during the 18th century.

- There was a need to protect the American continental Silver possessions. From my observations, during the 18th century, the Bourbon reforms were not designed to “enlighten” the colonies’ administrations. The Bourbon Spain´s political class, passing from Patiño, Campillo, Esquilache, and Floridablanca, were simply trying to defend the lands in Spanish America from the English and the French. The Bourbon political class were not policymakers with the objective of modernizing the colonies, they were anxious to preserve the colonies in America from the rest of the Empires. England´s Caribbean expansion was booming, and its Naval dominance by the time of the Seven Years´ War (1756-1763), “could mount simultaneous operations in the western pacific at Manila and in the Caribbean at Habana”.Moreover, the historians Barbara and Stanley Stein affirm that “the system that shaped, regulated, and ultimately integrated the economies of New Spain (México city) and Spain (Cadiz), with those of England and France, was constructed upon silver mining. Silver functioned as a major pole of growth in the agrarian-backward economies of Spanish colonies and the metropole. Silver as a pole of growth in the Spanish Atlantic system was compatible with the interests of Spanish and International Merchants (including the smugglers) but incompatible with the goals of the Bourbon economic nationalists in the times of King Charles III”. After Britain captured Havana in 1762, it was clear to the Spanish that the “English could easily become -los dueños de México-. Out of fear, Spain continued privileging silver mining, and “decapitalization occurred in the form of New Spain´s subsidization of the defense of Spain´s Caribbean possessions and transfers to Madrid on both, private and public royal account”.

- Finally, if you observe the flow of goods between Spanish America and Europe. Which country was truly benefiting from the silver of Spain?

Silver was being sent to Europe. But nothing of value was coming back from the agrarian Spain. Cacao, sugar, tobacco, and cotton as raw materials also followed precious metals. Colonial Spanish America was seen not as a basis for resource transformation into finished goods, but as a source of limited raw materials. The obsession of the Spanish crown with precious metals, the constant pirating and smuggling from other empires, and the lack of vision to try to diversify the portfolio mix towards non-mining products only proves that Madrid´s colonial policy during the 18th century of the Enlightenment was to focus on isolating Spanish America from the merchant community in which England was participating (Mainly from Kingston in the Caribbean). The core business of gold and silver didn´t allow the Bourbons to see beyond the protection of their lands from Britain. The mentality of the Spanish rulers was to “rise Spain”, pulling out precious metals to fill the coffers of the crown which was highly indebted. In the meantime, a new international class of global merchants (English, French, and Dutch) invaded the Atlantic, with the philosophy of contract, not with the philosophy of feudal privilege inherited from the Habsburg. To raise an economy, merely on silver output, restrained Spain and Spanish America from diversification and development. But that is what happened. The New Spain merchants kept their investments in mining and domestic agriculture. The Spanish merchants in Cadiz served as traders to receive flows of silver and re-export accordingly. Fear against England and North American traders is what kept the Spanish in immobilization conditions. On top of that England and the Habsburg Spanish Netherlands weaved a commercial history with Spain: Since 1540, “in England, almost all imported ingots arose from the new Spanish Silver, which by the end of this century had become a dominant Mint House silver supply. South American silver sustained the Spanish Netherlands Government and the Spanish armies to pass by England, where two-thirds of its amount was sent to the London Royal Mint. London became one of the most active Spanish silver markets. Silver arrived in Spain via Cadiz port, and from there, it was transferred from the Atlantic Spanish ports of Corunna, San Sebastián, and Bilbao to the English ports”(1).

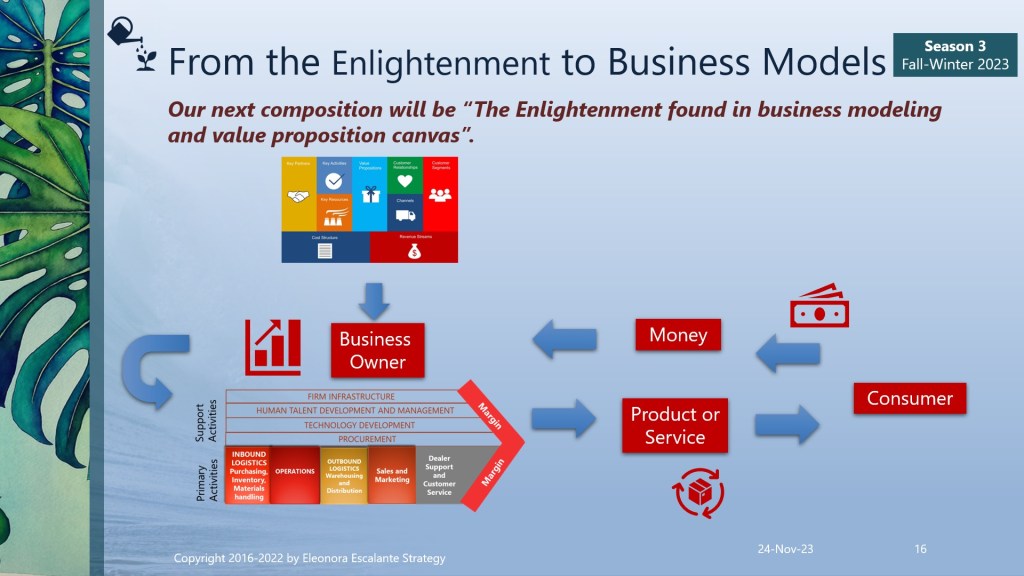

Announcement.

Adorable readers, we appreciate your desire to learn by doing your own strategic reflections, but this weekend, I wish you to relax. I have already finished with our inferences. The following episode (to be published next Friday 1st of December) will be “The Enlightenment found in Business Modeling and the Value Proposition Canvas“. Blessings and thank you for reading our episodes.

Musical Section

This week we will continue with more wind instruments from the Baroque period.

Today´s concert was composed by Carlo Tessarini da Rimini 1690–1767), another of the Italian Baroque masters who traveled and found in England and the Netherlands, not just possibilities, but at the same time, a good reputation. The video has been uploaded by the YouTube channel Brilliant Classics. The Artists: Gabriele Formenti (Flute), Il Bell’Accordo Ensemble (Ensemble) & Luca Ambrosio (Harpsichord).

Thank you for reading http://www.eleonoraescalantestrategy.com. See you next week.

Sources of reference that were utilized today. Look at slide 15.

(1) https://www.mdpi.com/2571-9408/1/2/30

Disclaimer: Eleonora Escalante paints Illustrations in Watercolor. Other types of illustrations or videos (which are not mine) are used for educational purposes ONLY. All are used as Illustrative and non-commercial images. Utilized only informatively for the public good. Nevertheless, most of this blog’s pictures, images, or videos are not mine. I do not own any of the lovely photos or images unless otherwise stated.