Central America:A Quest for the Progression of Economic Value.Season III. Episode 2. The School of Salamanca Part 2.

Dear fantastic readers

Today, we will show you the importance of the School of Salamanca to our times. We expect that you will be fascinated by our discoveries.

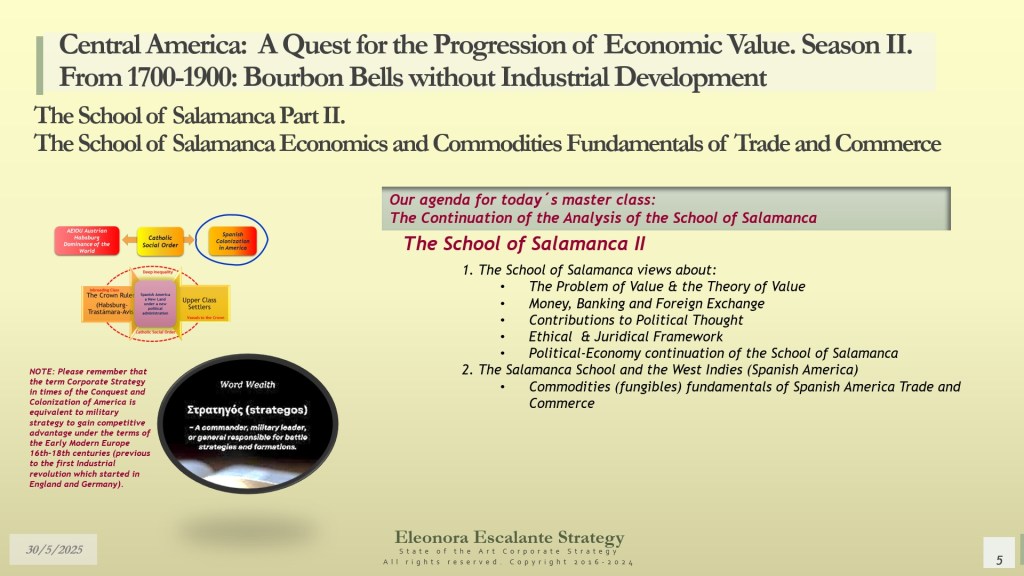

Why do we need to study the Salamanca School Doctors´ theories of the 16th-17th centuries?

Anyone interested in Latin American economic Development is required to study the roots of our beginnings under the international trade scene. And we are compelled to go back to 1492. This was the time in which people of the different European kingdoms cognized that there was something else in the future that offered an opportunity for prosperity beyond cloisters and monasteries. It was the time in which geographical exploration through the oceans led the main kingdoms of Europe to visualize that there was something else beyond the Italian merchants who took products from Asia and traded them on the shores of the Mediterranean and the Levant, up to the Baltic zone. The fall of the Byzantine Empire took a specific class of rulers out of that region, and they got involved with the Habsburgs of the Holy Roman Empire of the German Nations, who were very well connected with the Bourbons of the Low Countries. A marriage between Maximilian I and Mary Valois-Bourbon was the particular alliance that initiated a new way to accelerate the growth of trade and global commerce. According to Peter Bernstein (1), “with the new trade route to the Indies, the prospect of getting rich was highly motivating”. “The mentality of global trade was seen as a high-risk business. It translated the principles of gambling into the creation of wealth. The inevitable result was capitalism, the epitome of risk taking.” (1).

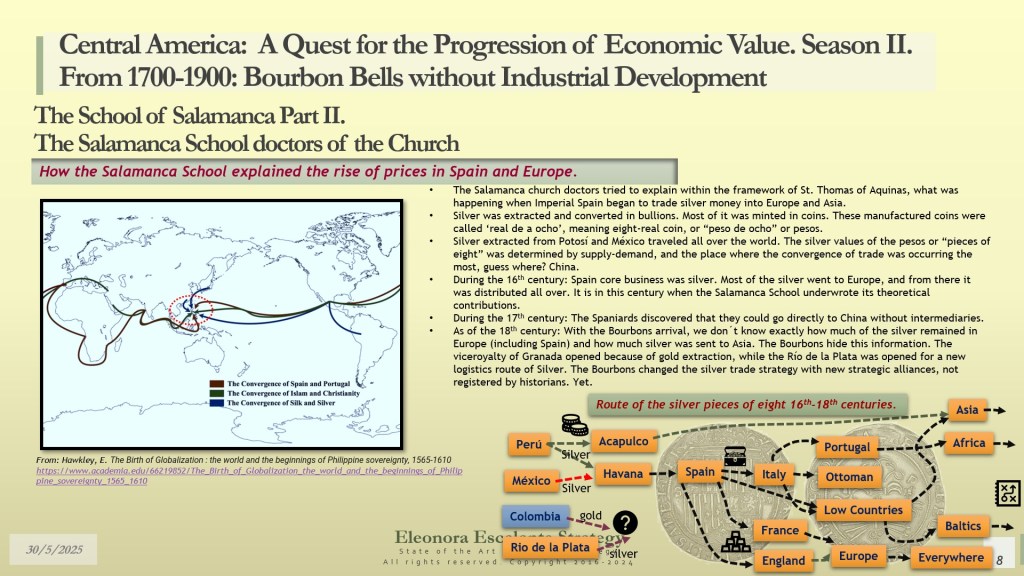

The century of the School of Salamanca doctors was a remarkable one for Europe. It was the century of the recognition that the world was bigger than Old Europe and Asia. It was the time of the invention of firearms and explosives, the invention of the compass, and the development of printing (1). On top, it was the time of the renaissance of mathematics through Italian personages as the physician Girolamo Cardano, Copernicus, and Galileo. Advances in calculus and algebra made it possible to trigger the laws of probability that the Dutch Huygens, the British Newton, the English statistician Graunt, and the German Leibniz were going to develop deeply in their universities during the 17th century. However, the money supply of silver from New Spain and Perú was not an extraction for fun or for finding pleasure in finding how to get rich. The silver products manufacturing value chain can´t be conceived as a “plundering or extraction” for the accumulation of wealth in Europe. It was the solution to the need for “money supply”. It was a piece of the puzzle in the first global monetary system in history. The silver of America made possible the first globalization strategy of trade. It was the first global century of trade between Western European kingdoms directly with Asia, in which the intermediaries were left behind.

The School of Salamanca was not a casual epistemological accident. Academics of the School of Salamanca were appointed to create the first theories of money, the first foundations of multinational financial management, foreign exchange, financing the world with silver, review the new forms of public finance, and the handling of massive amounts of new minted coins that were creating inflation. It is not a coincidence that the Dominicans who were appointed by royal decree to accompany the conquistadores of America were also the same Dominicans who were appointed by royal decree to validate a new system of money that was non-existent before Charles V Habsburg HRE. The money supply of silver coins was required for trade within the context of the nations involved. And the Dutch were leading the way then. According to Tracy (2), a financial revolution was triggered in Holland while the Doctors of Salamanca were writing their theories in Spain. And this financial revolution was only possible because there was new money coming from America. The Dutch state formation was the result of the Dutch public finance with its emergent capital market (3). The degree of sophistication of the Dutch financial solutions had a tremendous impact in Spain, England, France, and all around. England replicated it later by issuing a million pounds of annuities in 1693. England was also a main receiver of silver bullion from America.

Philosophically, what the doctors of Salamanca “indirectly” revealed was what Adam Smith wrote in 1776 (look at the roots of globalization, and where is the problem with our frameworks of corporate strategy analysis):

“What is prudence in the conduct of every private family can scarce be folly in that of a great kingdom. If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry employed in a way in which we have some advantage.” Adam Smith, 1776.

International business using silver extracted from America was not a plundering of Native America. It was the base, the bottom line, for raising cheap money produced in America, much required for the trade of the earliest multinationals of our history: the EIC, the VOC, the French East India companies, etc. These companies were using it to pay the Asians or the Indians, or the Africans for raw materials, luxury items, and slaves. Let´s read Adam Smith’s quote again, please. And you will perceive from when we are making philosophical mistakes in our economic theories today. The imbalance of the world of trade today has its roots here, with the occasion of the first monetary silver system that was formulated to take advantage of the main premises of the School of Salamanca, but not for the common good, but for the enrichment of the trading rulers. The creation of wealth and prosperity was not for improving the quality of life of the commonwealth.

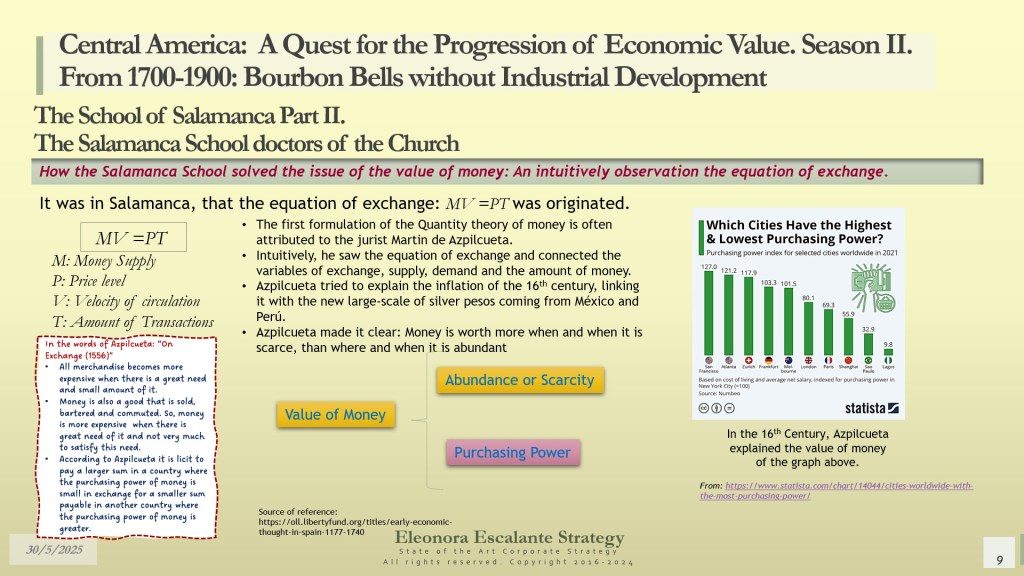

In consequence, for better and for worse, the establishment of the silver cash money supply from Spanish America to the world changed the modus operandi of trade, and it changed the societies. It is important to comprehend the philosophical impact of the money theories of the Salamanca School. Without them in history, we wouldn´t have been able to express that “inflation and currency depreciation are jointly determined by domestic money supply growth relative to money demand growth.” (4)

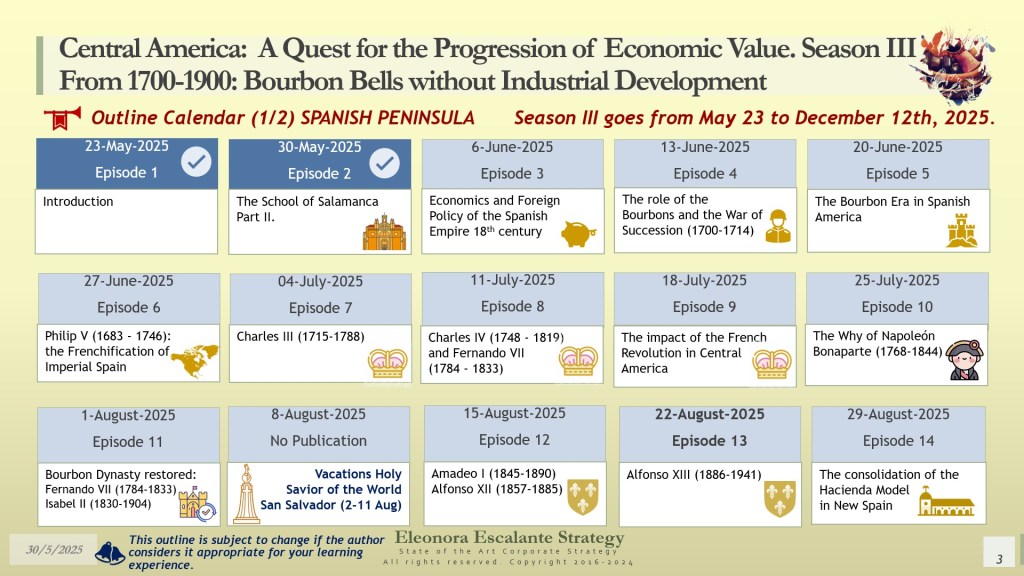

We have been working on the following slides as your frame of reference for your weekend analysis. Feel free to download this document. Print it and write your thoughts while doing it. Use the paper as your foundation for understanding. You can share it with your friends, family, colleagues, and students for further discussion.

We request that you return next Monday, June 2nd, to read our additional strategic reflections on this chapter.

We encourage our readers to get acquainted with our Friday master class by reading the slides over the weekend. We expect you to create ideas that might be strategic reflections or not. Every Monday, we upload our strategic inferences below. These will appear in the next paragraph. Only then will you be able to compare your own reflections with ours.

Additional strategic reflections after the weekend. Posted on Monday, 2nd of June, 2025.

- The money suppliers of the world. Imperial Spain was chosen to extract silver bullions and mint silver coins for a new system of global trade that was in the hands of the Dutch, the British, the French, the Portuguese, and the Asians. Visit slides 6, 7, and 8. In these slides, we show you that every nation was interested in creating wealth by transporting things from Asia to Europe. The inspiration of these empires wasn´t focused on creating strong centers of manufacturing in Europe (indeed, they did it randomly and focused much later, according to official history). Their aim was to replicate what the Italians did. They wanted to remove the power of the Italian merchants and bankers and travel the routes by themselves, in their quest to establish monopolies of trade. All the kingdoms involved in international business with Asia established royal monopolies. This means that there was total or partial participation of the monarchs in that trade. When absolutism took the spotlight at the royal families, the whole economic activity was a total royal monopoly. But what happened with the French? Apparently, it looks like they were left behind at the pinnacle of the change of the 1700s. Not at all. The Bourbons were always Habsburgs even before the marriage of Maximilian I of Austria with Mary the Rich of the Low Countries. Within the kingdoms of these times, they already had a tacit mercantilist value chain, and despite their succession conflicts, they were tied by family blood. Let me explain it simply: within families, there are always conflicts inside the circle, particularly in terms of hereditary rights; but the family as a block tends to protect itself from external forces. The Spanish Habsburgs in America was the stage one of the Austrian AEIOU strategy; they were the first ones to uncover and trade the riches of Spanish America, but they were fulfilling a long-term mandate for the whole family. When the Bourbon Habsburgs and the descendants of the Tudor-Castile dynasties continued their operations in North America, that was stage two. What occurred in North America was the second round of appropriation of the new lands, in which the value of labor capital was taken into account. By this time, the British, the French, and the Dutch had already learned from the mistakes of the Spanish Habsburgs, in such a way that they didn´t want to err in intent.

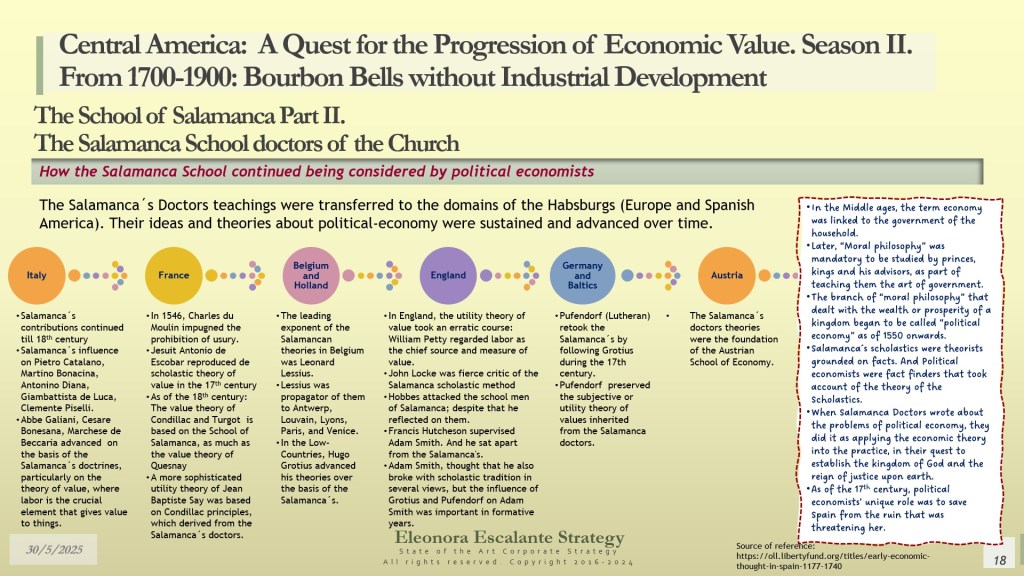

- The confidentiality of the Salamanca School discoveries was not a secret. Their theories evolved all over the universities of Europe, and these theories were considered by the successors of the political economy field. See slide 9. The merit of jurist Martin de Azpilcueta, regarding the equation of exchange, was remarkable. In Western Europe, can you imagine, these doctors created a theoretical economic equation simultaneously to when mathematician Cardano published “Ars Magna”, in chorus to the first appearance in publications of the symbols “+” and “-“ and “=”, and at the same time when Copernicus valuated the planetary system, and when Vesalius was producing his first treatise in anatomy? (1). Slide 10 is the summary of the positions of each of the main doctors of Salamanca, concerning value, “just price”, and the concept of “utility”.

- Academics were trying to help lay Spain’s long-term success. But they were not listened to after Philip II. When the Salamanca´s doctors established the notions and concepts of economics from their views of “moral philosophy”; and when they dared to evaluate the corollaries of terms as “just price”, “common estimation” (current market valuation), “subjective value”, the why of “inflation”, and the relationship between abundance or scarcity of products, money supply, supply and demand, and other costs (as labor); they were already clear of what took more than 200 years to be understood by the English and Scottish political economists. We wonder, if Spain held theoretical gurus of that caliber at the time of Charles V Emperor, what occurred then after Philip II (the next king)? What happened with the Habsburg-Spanish crown that wasn´t able to keep the advice of the academics close to their heart, at the same highest levels of what the Habsburg-Aviz envisaged… What truly happened after Philip II? What do you think? Official history explains that the Army of Flanders and the Spanish Road (1567–1659) was the strategy of Philip II to defeat the Low Countries, but we wonder what the truth was behind this situation. The flow of silver from America to Spain, and then towards Amsterdam, never stopped, despite the embargoes. It was flowing in considerable amounts through other intermediaries and trade centers (the French and British).

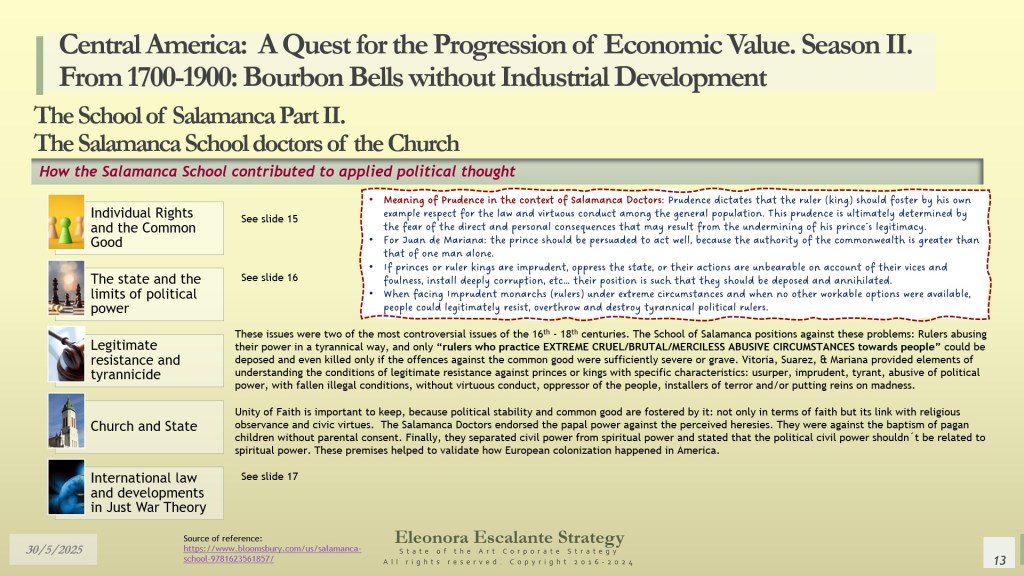

- The Salamanca Schools contributed to applied political thought.

Slides 13 to 16. Hutchinson and Alves-Moreira (5) coincide in suggesting 5 contributions of the School of Salamanca to political power:

a. Individual Rights and Common Good (slide 15),

b. The state and the limits of political power (slide 16),

c. Legitimate resistance and tyrannicide (slide 13),

d. Relationship of the Church and State (slide 13),

e. International law and developments in “Just War Theory” (slide 17).

Each of these slides is self-explanatory, and we have extended our explanations in each of the slides. However, there is an interesting point that we would like to remark here: the relationship between the ruler (the king, the prince, the legislators, etc.) and the common individuals (the majority, the commonwealth, the citizens). The Salamanca doctors paid special attention to what this relationship should be, not what it was. That tells us a lot about what was happening under the reigns of Charles V and Philip II. The scholastic gurus were speaking about an “ideal” political society. The Salamanca doctors (all of them) were against royal absolutism, which was starting to flourish with the abundance of silver. In the New World, Bartolomé de las Casas was the vivid testimony of the atrocities of the Conquistadores, and he drove his Dominican fellows positioned in Spain, to defend the cause of the Indians as “humans who deserved respect from other humans.” We wonder what type of massive destruction was not disclosed, and how all the registered testimonies of the conquered Indians were burned. What type of conquest was it? What type of new international monetary system was emerging over the destruction of the Native Americans? What was happening to have attracted Dominicans and Jesuits to the School of Salamanca (the royal university patronized by the Habsburgs) in their quest to provide and influence with an academic framework of reference that could be respected by the new educated elite feudal class that was being sent to America or was taken positions of relevance within the Courts of Spain and beyond. - The Salamanca school persevered until the Austrian School of Economics took their foundations again with Carl Menger (1840-1921).

Slide 18. Nothing happens by accident. There is no twist of fate in the location of the Salamanca Doctors. They were crucial in Spain when Silver began to flow from Spanish America to Europe and Asia. The galleons going to the Philippines were not an accident by luck either. As a spiral of knowledge, the Salamanca teachings of Vitoria, DeSoto, Covarrubias y Leyva, Azpilcueta, De Molina, De Lugo, De Mercado, Mariana, Suarez, and the rest, were not supposed to be overlooked. Their influence traveled to the rest of the universities, including the new ones established in America. The Monarchies required well-trained lawyers, bishops, and professionals to consolidate their councils and jurisdictional institutions. The visionary mindset of the School of Salamanca doctors anticipated the economic theories and financial analysis that Adam Smith and Carl Menger consolidated much later without St. Thomas Aquinas’ content. Adam Smith wrote about the respect for human values to counteract or offset the negative consequences of “The Wealth of Nations”. However, Carl Menger didn´t include anything about God. Menger’s theoretical frameworks are largely secular and do not rely on religious or theological concepts at all. - In summary. Money in abundance was the new product of the 16th to 18th centuries. We perceive that it was the duty of Imperial Spain to supply it. Its large quantity required a sound and solid strategy to sell it globally, and an academic framework was mandatory and essential to push it into acceptance by the rest of the European kingdoms. Without the trade of spices, silk, and luxury items from Asia to Europe, performed by the Dutch, British, French, and Portuguese fleets, the need for Silver coins wouldn´t have picked up. China was pivotal for European trade, as much as it was important later for the British.Additionally, this episode shows the relationship between academia and practice, and how important it was for the Spanish Habsburg monarchy to rely on it for further domestic and international commerce policies. The imports of silver from the Americas reached 80-90% of the total world supply in the middle of the 17th century (6). And the monarchs of the kingdom of Spain controlled the total value chains of its production (through private testaferros), from the mines to the ports where the clients awaited it. Despite the main economic elements of the School of Salamance representatives continued to be considered over time, the elements of St. Thomas Aquinas were buried, and God was totally forgotten over time.

The whole monetary system of the world was relying upon silver from Imperial Spain (despite its crisis), and it remained as such when the Bourbon Habsburgs came into power. See slide 19.

Announcement:

With this episode, we are offering an interesting lesson about how academics (the School of Salamanca doctors) perceived the political-economy issues of Spain, while facing the transfer of silver coins from America to all over the world. Contrary to the extraction economy theory, the role of Spain as of the 16th century, after the discovery of the silver mines in America, wasn´t a simple transference of coins. It changed the model of societies, and it triggered a global cycle of money supply, banking, public and private finance, trading, and prosperity of the main merchants of the epoch: the VOC, EIC, and the rest of the players involved in minting and the organization of the monetary policies. This is the context in which the Spanish Habsburgs passed the power baton to their relatives, the French Bourbon Habsburgs. Let´s learn what happened in the 18th and 19th centuries in America, then. Next week, our next episode is “Economics and Foreign Policy of the Spanish Empire 18th century”.

Musical Section.

Season III of “Central America: A Quest for the Progression of Economic Value” has assigned a new instrument for the rest of the year. It is the guitar!. Our selection of music during Season III will continue to explore adorable music produced between the 17th and 19th centuries with interpretations of virtuoso guitarists. We will embark on the selection of the top 29 loveliest guitarists from the last 5 generations, playing music composed during the time of this saga. Our choice for today´s episode is the Croatian Ana Vidovic interpreting J.S. Bach – Partita in E major. I would like you to visit her website https://www.anavidovic.com/biography/. Delight in the majestic performance of her guitar. Enjoy

Thank you for reading http://www.eleonoraescalantestrategy.com. It is a privilege to learn. Blessings.

Sources of reference and Bibliography utilized today. All are listed in the slide document. Additional material will be added when we upload the strategic reflections.

Bibliography:

- Bernstein, Peter. Against The Gods- The remarkable history of risk. John Wiley & Sons, Inc. 1998.https://www.wiley.com/en-nl/Against+the+Gods%3A+The+Remarkable+Story+of+Risk-p-9780471295631

- Tracy, J. D. A financial revolution in the Habsburg Netherlands: “renten” and “renteniers” in the county of Holland. 1515-1565. Berkeley, 1986 https://www.ucpress.edu/books/a-financial-revolution-in-the-habsburg-netherlands/paper

Fritschy, W. A financial Revolution Reconsidered: Public Finance in Holland during the Dutch Revolt (1568-1648). The Economic History Review, Vol 56. NO. 1. Feb. 2003. http://www.jstor.org/stable/3698754?origin=JSTOR-pdf- Shapiro, Alan C. Foundations of Multinational Financial Management. 3rd. Edition. Prentice Hall, 1998. https://archive.org/details/isbn_9780137645077

- Alves, A.; Moreira, The Salamanca School. Volume 9. Bloomsbury : https://www.bloomsbury.com/us/salamanca-school-9781623561857/ Hutchinson, Marjorie. Early Economic Thought in Spain 1177-1740. Liberty Fund. https://oll.libertyfund.org/titles/early-economic-thought-in-spain-1177-1740

- Gherardi, F. and Pelsdonk, J. Investigating the Sources of Silver in the 17th and 18th century silver coins from the Rooswijk Shipwreck by Compositional Studies. MDPI. 2025 https://www.mdpi.com/1996-1944/18/5/925

Disclaimer: Eleonora Escalante paints Illustrations in Watercolor. Other types of illustrations or videos (which are not mine) are used for educational purposes ONLY. All are used as Illustrative and non-commercial images. Utilized only informatively for the public good. Nevertheless, most of this blog’s pictures, images, and videos are not mine. Unless otherwise stated, I do not own any lovely photos or images.